Single Hsa Contribution Limit 2025. The 2025 hsa contribution limit for. Here's what you need to know about that maximum, employer matches and how much you should contribute to maximize.

2 here’s a quick breakdown of the 2025 hsa. The health savings account (hsa) contribution limits effective january 1, 2025, are among the largest hsa increases in recent years.

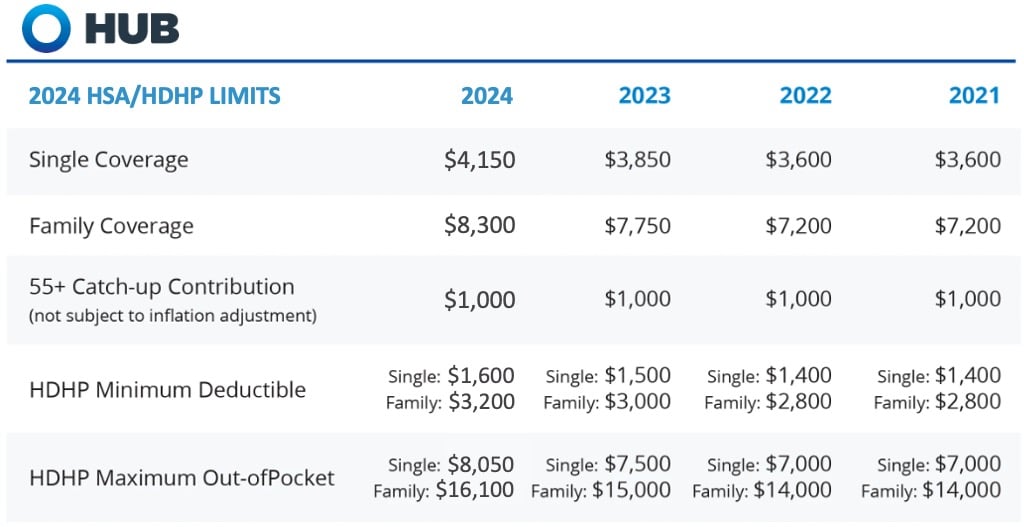

Significant HSA Contribution Limit Increase for 2025, For individuals covered by an hdhp in 2025, the maximum contribution limit will be $4,150. For 2025, the aca oop limit is $9,200 for single coverage and $18,400.

Hsa 2025 Family Limit Ciel Melina, The new tax regime now offers a full tax rebate on income up to ₹ 7. For 2025, the aca oop limit is $9,200 for single coverage and $18,400.

Hsa 2025 Contribution Limit Chart By Year Sheba Domeniga, The ira contribution limit in 2025 was $6,500 ($7,500 for those age 50 or older). For 2025, you can contribute up to $4,150 if you have individual coverage, up from $3,850 in.

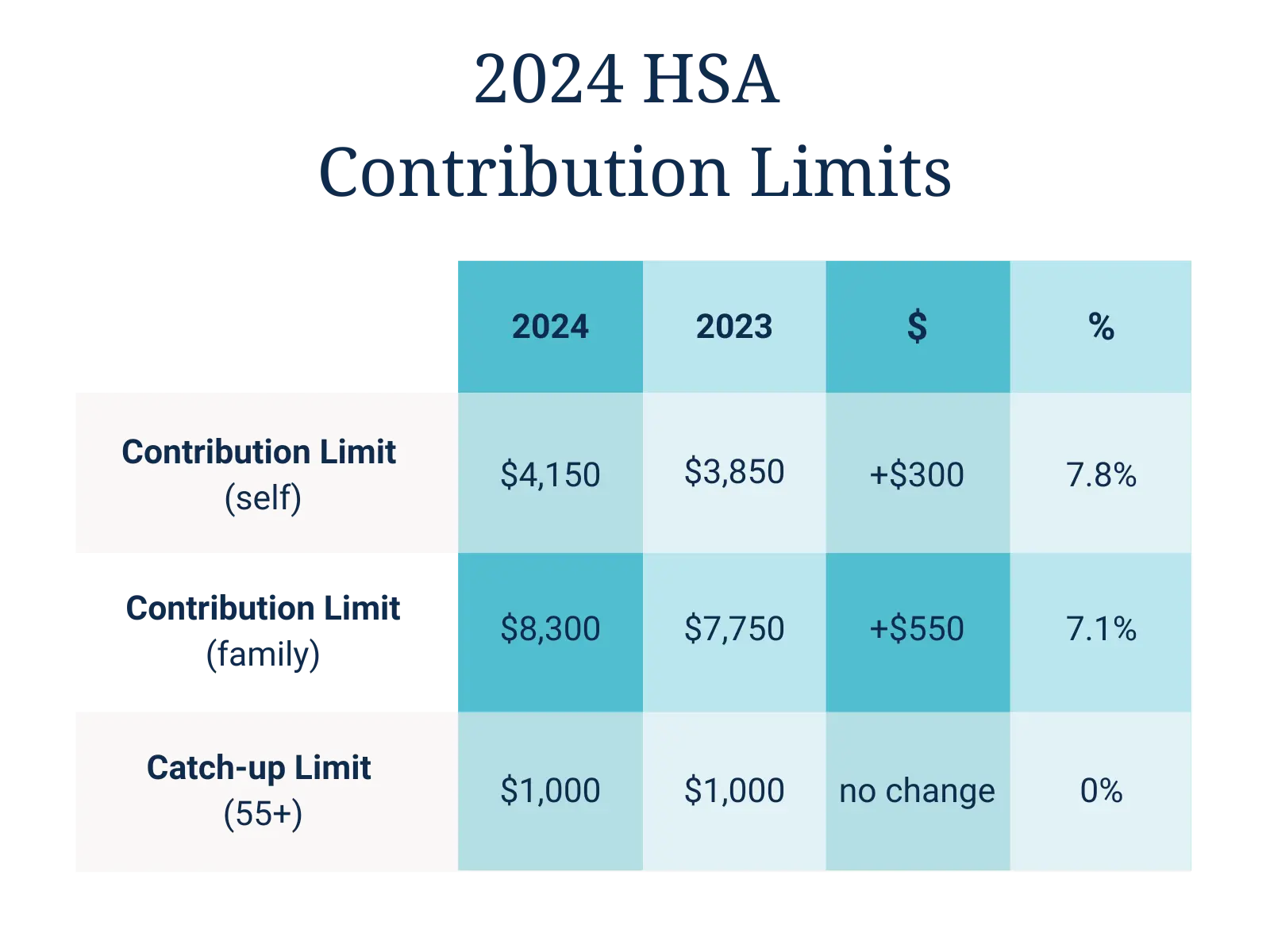

Max Contribution Limit For Hsa 2025 Denni Felicia, The health savings account (hsa) contribution limits effective january 1, 2025, are among the largest hsa increases in recent years. Annual hsa contribution limits for 2025 are increasing in one of the biggest jumps in recent years, the irs announced may 16:

2025 HSA Contribution Limits Claremont Insurance Services, The maximum contribution for family coverage is $8,300. Employer contributions count toward the annual hsa.

Hsa Limits 2025 Lucie Robenia, The 2025 hsa contribution limit for individual coverage increases by $300 to $4,150. You could have made a 2025 contribution until the tax filing deadline in 2025.

2025 HSA contribution limits, The 2025 hsa contribution limit for families is $8,300, a 7.1% increase from the 2025 limit of $7,750. The internal revenue service (irs) increased hsa contribution limits for 2025 to $4,150 for individuals) and $8,300 for families.

IRS Makes Historical Increase to 2025 HSA Contribution Limits First, The hsa contribution limit for family coverage is $8,300. You could have made a 2025 contribution until the tax filing deadline in 2025.

Hsa Pre Tax Contribution Limits 2025 Tobye Leticia, You could have made a 2025 contribution until the tax filing deadline in 2025. The 2025 hsa contribution limit for families is $8,300, a 7.1% increase from the 2025 limit of $7,750.

Healthcare Limits 2025 Vanna Jannelle, Here's what you need to know about the latest hsa contribution limits from the irs and how you could maximize your triple tax advantage annually. In 2025, there was a notable increase in the tax rebate limits under the income tax act, 1961.

Here's what you need to know about that maximum, employer matches and how much you should contribute to maximize.

Individuals can contribute up to $4,150 to their hsa accounts for 2025, and families can contribute up to.